Temenos Digital Spotlight Overview

Banks and credit unions need an administration product to manage their digital banking products. They not only require a user-friendly interface for their staff, but also a solution that is flexible and extensible to align with their specific business processes. Some banks and credit unions also need the ability to own and manage their customers' data themselves, instead of relying on third-party vendors. Although this places the onus on the banks and credits unions to conduct regulatory audits on the data, they can utilize and mine this data on their own. For example, analytics-driven or contextual offers.

For information on features added in different releases, refer Revision History.

The Temenos Digital Spotlight application (previously known as Administration Console) caters to multiple types of internal users, including but not restricted to:

- Lines of business

- Customer service

- Digital banking team (manage products, static content, transaction queues, and so on)

- IT/Security team

The purpose of this solution is to set up and maintain customer and employee-related information and to configure the behavior of digital banking applications associated with this information. The solution holds key data around user profiles and static content, and is also designed to interface with various back-end systems. For example, a core banking system for accounts and transactions.

At the heart of this solution is a common data model that has been designed based on years of experience working with leading banks and credit unions. The application is designed and developed in close collaboration with real users of Temenos financial services customers. Web services are exposed in case external systems need to access this application. The customer data is stored in a database designed by Temenos and the customer has to host the database. Alternatively, if a bank chooses to use its own database or a third-party user management system, the integration services must be modified and suitably mapped to a common data model. In case of push notifications and emails, the Quantum Fabric messaging product can be used, and at the same time sending email via third-party websites is also supported. The user interface is internationalization-ready, browser-based, and has been validated by employees of these financial institutions.

For details on the Temenos Digital Spotlight application features and functionality, see Temenos Digital Spotlight Features.

Other references:

- UI/UX Design considerations for the Spotlight Application

- Integration Services in Spotlight

- Technical flows in Spotlight

At a high-level, Temenos Digital Spotlight provides the following capabilities:

- Employee Management: Create and manage employee accounts along with their roles and permissions for using the Temenos Digital Spotlight application.

- Customer Management: View and manage customer profile details as required; assign groups and entitlements to manage the retail banking application behavior for individual or group of customers.

- Application Content Management: Configure the static content displayed in the end-user applications like Terms and Conditions, Privacy Policies, FAQs, etc.

- Master Data Management: Creation and management of the master list of information like customer care centers, bank / ATM locations, list of services offered by the bank in digital banking applications and more.

- Reports and Logs: View and maintain activity logs for employee and customers on digital channels, summary reports for activities and transactions.

- Customer Service: Capability to view and respond to messages sent by customers; view and update customer profile. Select administration users who have the capability to remotely login on behalf of customers and help them with their online banking troubleshooting.

- Dashboard: Landing page with the summary of messages received and information useful for employees.

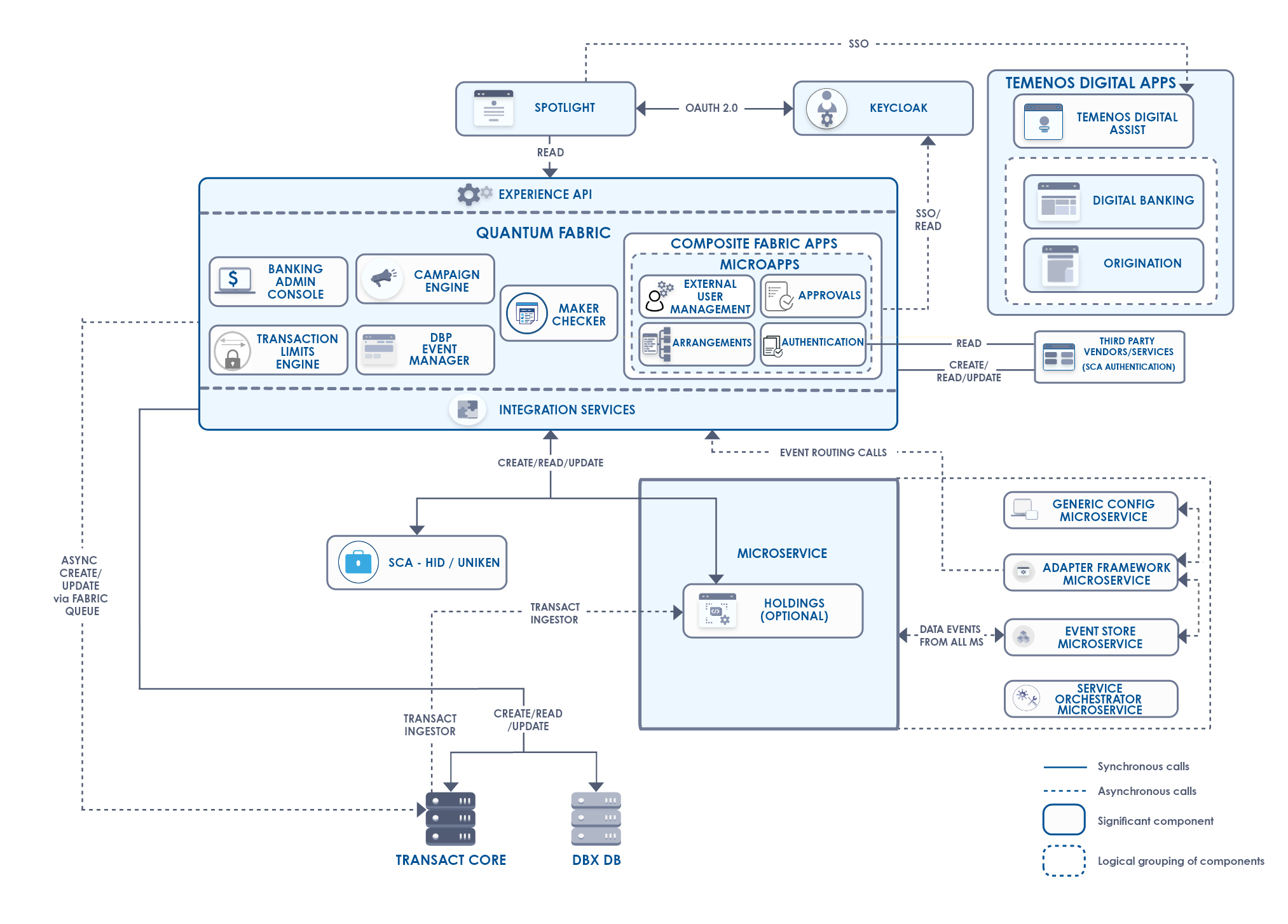

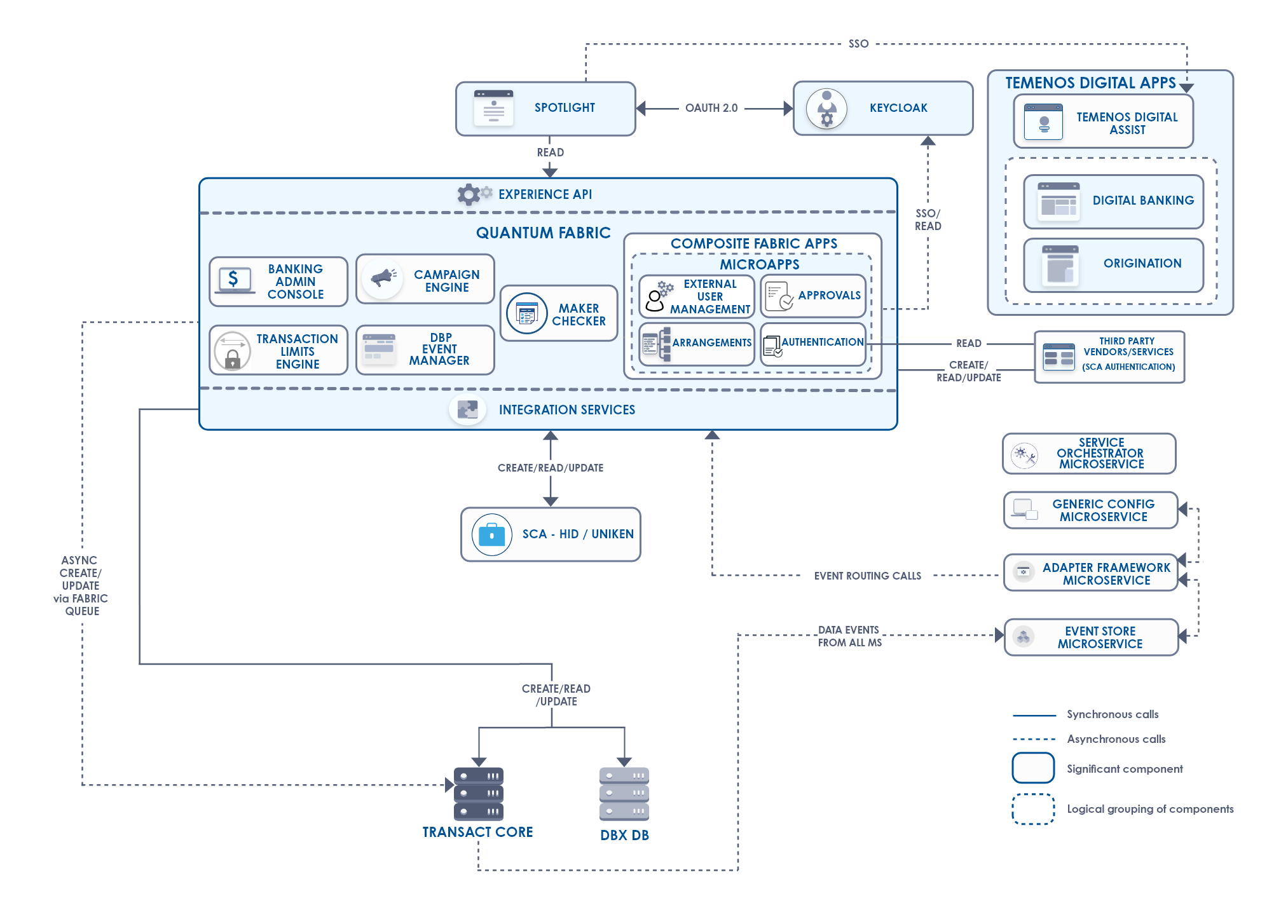

Architecture

In this topic